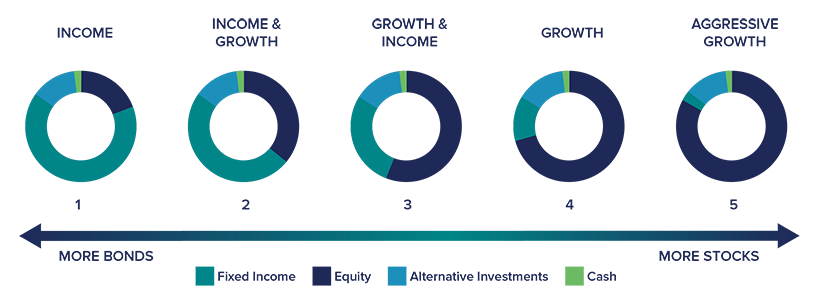

The underlying foundation of our investment philosophy is the construction of a globally diversified portfolio based on strategic asset allocation. Strategic asset allocation is a strategy that divides up a portfolio among major asset classes (equities, bonds, cash equivalents, and alternative investment vehicles) in proportions that are consistent with an investor's long-term financial goals and objectives, establishing a "base policy mix". This mix of assets is based on expected rates of return and risk for each asset class.

At Ladenburg, we construct and maintain our core asset allocations through the use of both fundamental and quantitative data. When determining an asset allocation, we review the last ten years of data history with the mindset that the last decade is more relevant to the anticipated decade as opposed to using the entire history of the market. We employ a stringent due diligence process in selecting what we believe are the best possible investment solutions and an unwavering objectivity enforces accurate positioning in portfolios, to achieve long-term investment goals.

Studies examining investment portfolios over time found that asset mix — the combination of money market, income and growth investments — accounts for more than 90% of a portfolio's return over the long term. In other words, the allocation of investments to each asset class is far more important than the selection or timing of individual investments. Although the mix between equities and fixed income, broadly defined, is typically the most important asset allocation decision, proper diversification requires that a portfolio be allocated among several distinct asset classes including alternative investments. Within the broad equity asset class, examples of "sub-asset classes" would include large capitalization equities, small capitalization equities, domestic equities and foreign equities. Within the broad fixed income asset class, sub-set classes vary according to maturity/duration (e.g. short, intermediate, long-term); type of issuer (e.g. government, corporate, municipal); and credit quality.

STRUCTURED, NOT STATIC

Our portfolios are carefully structured and designed for long-term investing — with low expense ratios— but they are not static. We use a top-down approach, considering both a macro view of the economy and the markets, as well as a careful analysis of investment fundamentals. In simple terms, this means that we continuously assess and reassess our strategic allocations, adjusting them when necessary.

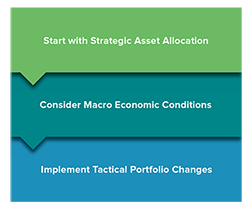

While we firmly believe in a long-term approach to investing, we do not subscribe to a "buy and hold" philosophy. Rather, we take steps to adjust portfolios, recognizing that it is important to be proactive, without compromising the integrity of the underlying strategy of a given model. With our long-term framework in place, our focus is then three-fold:

While we firmly believe in a long-term approach to investing, we do not subscribe to a "buy and hold" philosophy. Rather, we take steps to adjust portfolios, recognizing that it is important to be proactive, without compromising the integrity of the underlying strategy of a given model. With our long-term framework in place, our focus is then three-fold:

Our tactical overlay essentially helps us determine which areas to under or over-weight based on market conditions. We will recommend a portfolio change where we can either reduce the risk in the portfolio or potentially add a higher rate of return, given a certain level of risk. In stepping through this process, our Investment Committee focuses a great deal on top down (macro environment).

The return and principal value of an investment will fluctuate so that, when redeemed, they may be worth more or less than their original cost. Economic and market conditions effect the performance of an account. Since no one investment program is suitable for all types of investors, this information is provided for informational purposes only. You should review your investment objectives, risk tolerance and liquidity needs before selecting a suitable investment program. Not FDIC Insured